ANZ Customer Transaction Dispute Form 2015-2026 free printable template

Show details

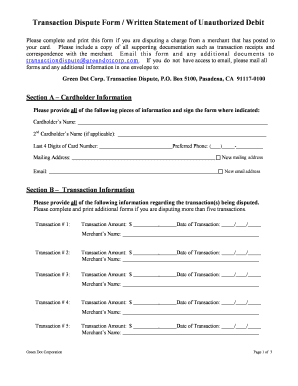

Customer Transaction Dispute Form OPTIONS AVAILABLE TO LODGE A DISPUTE Telephone Please contact ANZ on 13 13 14 ANZ Internet Banking Select Lodge a transaction dispute from the Account Overview screen or SecureMail section. PLEASE COMPLETE ALL SECTIONS BELOW AND RETURN VIA FAX/MAIL/EMAIL TO THE CONTACT DETAILS LISTED ON PAGE 2 ANZ Card Number or BSB Account / Cardholder s Name Preferred Contact No Email 1. I WISH TO DISPUTE THE FOLLOWING TRANSACTION S Date Transaction Details Amount AUD...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign support pdf filler form

Edit your form transaction customer dispute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct express dispute form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit direct express dispute form online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit customer transaction dispute form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out visa dispute form

How to fill out ANZ Customer Transaction Dispute Form

01

Begin by downloading the ANZ Customer Transaction Dispute Form from the ANZ website or banking app.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide your account number associated with the disputed transaction.

04

Clearly state the date and amount of the transaction you are disputing.

05

Describe the nature of the dispute (e.g., unauthorized transaction, incorrect charge, etc.).

06

Attach any relevant documentation or evidence to support your dispute, such as receipts or transaction history.

07

Review the form for any errors or omissions.

08

Sign and date the form at the designated fields.

09

Submit the completed form to ANZ via the specified method (e.g., by mail, in-person at a branch, or electronically if allowed).

Who needs ANZ Customer Transaction Dispute Form?

01

Customers who have identified an error or unauthorized charge on their ANZ bank account.

02

Individuals needing to resolve issues with transactions that do not match their records.

03

Anyone requiring documentation to formally dispute a financial transaction.

Fill

money network dispute form

: Try Risk Free

People Also Ask about anz transaction dispute form

What is the best way to dispute a transaction?

Call the customer service number on the back of your credit card or on your statement. Email customer service. Dispute through the financial institution's app. Dispute the transaction in writing (the address should be on your statement)

What is customer dispute form?

Customer Dispute Form means a form used to record details of a matter with a patron that cannot be immediately resolved.

How do I dispute a transaction and win?

How to Win a Credit Card Dispute Contact the Merchant First. If there's a clerical error or another issue with your credit card bill, it's best to try and resolve it with the retailer. Avoid Procrastinating. Prepare to Make Your Case. Know Your Rights. Stand Your Ground.

How do I file a transaction dispute?

Transaction Disputes vs. A customer can initiate a transaction dispute by contacting the issuer (the bank associated with the payment card used in the transaction). The cardholder will ask the bank to reverse the charge; the bank examines the circumstances and determines if there is a legitimate reason to do so.

How do I dispute a transaction and get my money back?

How to request a chargeback You file a chargeback request. Your card issuer reviews the dispute and will decide if it's valid or if you have to pay. The card network reviews the transaction and either requires your card issuer to pay or sends the dispute to the merchant's acquiring bank.

How do I write a dispute letter for a transaction?

I am writing to dispute a charge of [$] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc.].

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dispute transaction example to be eSigned by others?

Once you are ready to share your anz refund transaction, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out chargeback form template on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your home depot site pdffiller com site blog pdffiller com, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out anz complaint form on an Android device?

Use the pdfFiller mobile app to complete your ANZ Customer Transaction Dispute Form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is ANZ Customer Transaction Dispute Form?

The ANZ Customer Transaction Dispute Form is a document that customers use to report and dispute specific transactions on their bank accounts, typically involving unauthorized or incorrect charges.

Who is required to file ANZ Customer Transaction Dispute Form?

Customers who notice discrepancies or unauthorized transactions on their accounts are required to file the ANZ Customer Transaction Dispute Form.

How to fill out ANZ Customer Transaction Dispute Form?

To fill out the ANZ Customer Transaction Dispute Form, customers should provide their personal details, account information, details of the disputed transaction, an explanation of the dispute, and any supporting documentation.

What is the purpose of ANZ Customer Transaction Dispute Form?

The purpose of the ANZ Customer Transaction Dispute Form is to formally challenge a transaction that a customer believes is incorrect or unauthorized, allowing the bank to investigate and resolve the issue.

What information must be reported on ANZ Customer Transaction Dispute Form?

The form must include the customer's name, account number, transaction details (date, amount, merchant), a description of the dispute, and any relevant supporting evidence.

Fill out your ANZ Customer Transaction Dispute Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ANZ Customer Transaction Dispute Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.